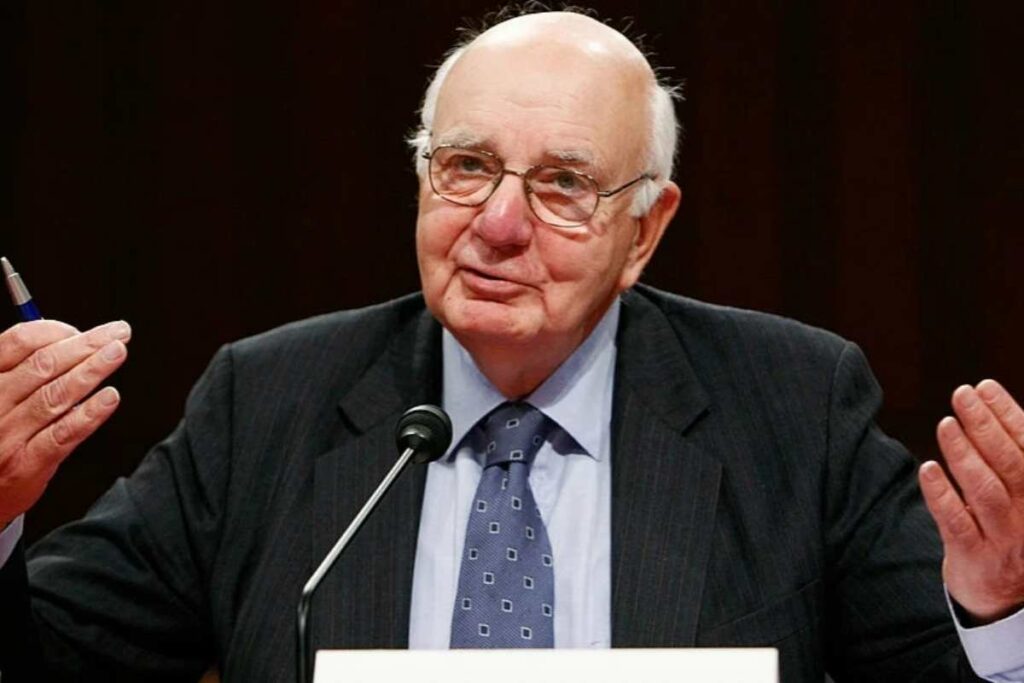

This week, Jerome Powell, the chairman of the Federal Reserve, issued a loud and obvious message to the financial markets: Interest rates will stay high until inflation falls and stays low. Powell’s message was communicated in a succinct, direct statement on Friday at the year’s most important conference of central bankers around the world, the Jackson Hole economic symposium. Powell’s comments caused stocks to plunge, indicating that investors understood what he was saying. The late Paul Volcker’s spirit and wisdom were with Powell when he approached the podium at the Jackson Lake Lodge on Friday, though. Volcker presided over the Fed from 1979 to 1987 until passing away in December of that year.

One major accomplishment during his term stands out: ending the inflation that ravaged the American economy through the 1970s and into the early 1980s. However, these initiatives did not advance in a straight line. Volcker increased interest rates from about 11% to 17.5% between August 1979 and April 1980. Over this time, inflation increased from 11.8% to 14.5%. A lull in inflationary pressures in the summer of 1980 led Volcker to commit a mistake that Powell has sworn not to repeat: the Fed cut interest rates. Benchmark rates fell to 9% in July 1980, the lowest level in the previous two years. Although it was on the decline, inflation was still above 12%. A new round of rate hikes started.

For the first time in three years, inflation was consistently below 10% by the winter of 1982. The Federal Funds Rate remained above 14%. The next time benchmark rates dropped below 9% was in December of that year. The Fed funds rate didn’t drop under 8% until 1985. The U.S. economy was experiencing its second inflationary boom in the previous six years when Volcker took office as Fed chair. The fears of “stagflation” that have surfaced during our current inflationary period were actualized in the late 1970s and early 1980s.

The Fed needed to take drastic action, but it also needed to be persistent and patient in order to finally stop inflation. As high inflation gets more entrenched in pay and price setting, history demonstrates that the employment costs of bringing down inflation are likely to rise over time, Powell warned on Friday. The unemployment rate in the United States increased from 7.2% to 10.8% between July 1981 and December 1982, reaching a peak that wouldn’t be attained again until the pandemic-induced recession that brought it as high as 14.7% in April 2020. The effective Volcker deflation in the early 1980s came after numerous unsuccessful deflation attempts over the preceding 15 years, according to Powell.

“In order to stop the high inflation and begin the process of bringing inflation down to the low and stable levels that were the norm until the spring of last year, a protracted period of extremely restrictive monetary policy was ultimately required. By taking resolute action right away, we hope to prevent that outcome.” The stock market rose over the majority of the summer as bond yields fell as some investors staked that the Powell Fed would fall short in the crucial area of “lengthy-term” in this historical comparison. By the end of July, the markets were already pricing in a rate cut from the Fed as early as next year. This is because rates are expected to increase by another 100 basis points by the end of the year, according to the Fed’s own June predictions.

And Powell appears to be especially keen to dispel this particular doubt. Lead U.S. Economist at Oxford Economics Lydia Boussour wrote in a note on Friday: “In the run-up to Fed Chair Powell’s Jackson Hole Symposium speech, there was a growing sentiment among market participants that the Fed will soon make a dovish pivot as Chair Powell noted at the [July 27] post-FOMC press conference that ‘at some point’ it would be appropriate to slow the pace of rate tightening.” According to Boussour, “Fed Chair Powell leaned against the more dovish narrative and delivered a hawkish message [on Friday] that policymakers “will keep at it until [they] are confident the job is done” given the danger that an early easing in financial conditions could undermine the Fed’s effort to fight inflation and credibility. Paul Volcker famously observed in an interview.

that “inflation is looked at as a terrible, and perhaps the cruelest, tax because it hits in a many-sectoral, unanticipated fashion, and it hurts the people on a fixed income hardest.” The repeated assertion by Powell that the burdens of high inflation fall hardest on those least able to bear them—the poor, the unemployed, and the elderly—is the current equivalent of this viewpoint. Powell stated on Friday that “the economy does not work for anyone without price stability.” “It will take some time to bring back price stability, and we must use forcibly our tools to better balance supply and demand. It seems anticipated that a protracted period of growth below trend will be necessary to lower inflation. A slight softening of labor market conditions is also extremely likely. ” In other words, the Fed anticipates a slowdown in the economy to lower inflation.

There will be employment losses. Many have already. The strong wage growth of previous years could slow. These are the regrettable side effects of deflation, Powell remarked. But failing to bring back price stability will cause even more suffering. The central bank is prepared to pay these prices in order to reduce inflation. A payment that the Fed has previously missed its deadline for. And one that it won’t miss once again. A former Fed chair, whose influence was felt this week in Wyoming, learned a valuable lesson.

For more news like this stay tuned with newsconduct.com