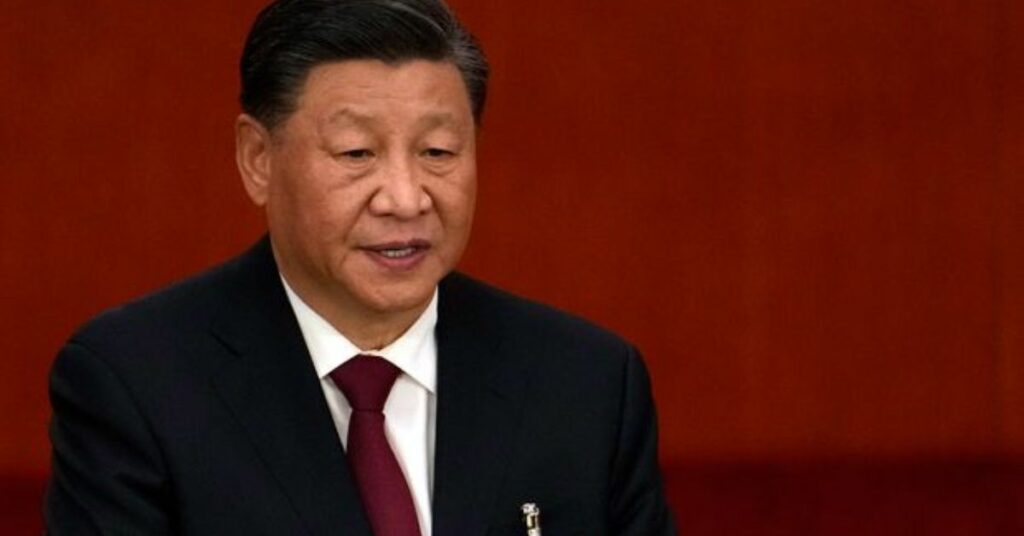

With the likely revival of a powerful committee to coordinate financial policy and the possible appointment of a key ally in a top position at the central bank, Chinese President Xi Jinping is set to bring decision-making of the financial system further under his control. This will be accomplished by bringing decision-making of the financial system further under his control.

According to people familiar with the matter, the authorities are reportedly contemplating resurrecting the Central Financial Work Commission after it had been dormant for a considerable amount of time. This would give the Communist Party, which is currently in power, a greater degree of control over financial policy. One of the people indicated that Xi’s chief of staff, Ding Xuexiang, is going to take over as the leader of the corporation. This person asked not to be identified since they were discussing a private topic.

According to a report in the Wall Street Journal, He Lifeng, who is in the running to succeed Liu He as China’s vice premier responsible for economic policy in a cabinet reshuffle scheduled for the following month, is also being considered for the role of party secretary at the People’s Bank of China. Liu He is expected to be replaced by He Lifeng.

While highlighting the strategic importance of China’s $60 trillion financial sector, the appointment of a new financial regulator and the possibility of overhauling China’s financial regulatory regime would result in the decision-making authority over key economic policies being concentrated in fewer hands and centralized under Xi. A vice premier who holds a high post at the People’s Bank of China (PBOC) would also boost the PBOC’s involvement in the regulation of financial markets.

Since Xi took control of the party in 2012, he has worked to consolidate his position by packing the leadership of the party with loyalists. At the party’s conference in October of the previous year, he was able to secure a third term in power, breaking all previous records.

Current PBOC party chief Guo Shuqing, said

“There’s no doubt that He Lifeng has a much, much closer personal relationship to Xi than”

Christopher Beddor, deputy China research director at Gavekal Dragonomics. “If he’s ultimately appointed to replace Guo, markets will probably view that as Xi gaining somewhat more direct oversight of the central bank.”

The WSJ was the first publication to mention the likelihood of Zhu being appointed and the revival of the financial work committee. When asked for comment by Bloomberg News, the PBOC declined to provide a response.

More Breaking News:

- Analysts Warn That Carvana’s Stock Will Fall Because Of Its Quarterly Loss

- What Happened To Tom Tierney Did Tom Tierney Commit Suicide?

In recent years, the functions of party secretary and governor at the PBOC have been differentiated from one another. The management of financial risk has been the primary focus of Guo Shuqing, the current party secretary of the People’s Bank of China (PBOC), who is set to retire soon. Since the beginning, Yi has been in charge of implementing monetary policy.

Analysts believe that the recent changes at the PBOC may not indicate a significant shift in monetary policy, despite the fact that the central bank’s attitude may become slightly less hawkish as a result of these changes.

Said Gavekal’s Beddor

“It’s really hard to imagine just about any successor who would be as hawkish on monetary policy and banking regulation as Guo Shuqing”

Beddor said

He Lifeng has spent most of his career in local governments, and advocated for infrastructure-building. That means “he might not bring the same level of vigilance about the dangers of debt as Guo Shuqing or Liu He”

The head economist for Greater China and North Asia at Standard Chartered Plc, Ding Shuang, stated that the route of monetary policy reform “would likely continue on the reform direction that has already been defined, and won’t be susceptible to a completely new thought or any dramatic change.”

He Lifeng, who is currently in charge of China’s state planning agency, is Xi Jinping’s trusted advisor and has traveled with the president of China on multiple occasions over the past few years. The two people have been acquainted with one another since the 1980s.

The intellectual and international credentials of the top two officials at the central bank would be significantly lowered if Zhu and He were to be appointed to their current positions at the PBOC. Zhu has worked in China’s state-owned banking sector for the majority of his career.

He was a PBOC deputy governor until being promoted to the position of chairman at Citic in 2020. The problematic bad-debt manager China Huarong Asset Management Co. was rescued under his control by Citic, which played a significant role in the operation. Although He Lifeng has a degree in economics, he is not widely recognized as an economic thinker. Instead, he has spent almost all of his career working in government administration.

He is expected to replace Liu He, who is well-known in international circles after leading China’s negotiating team in contentious trade talks with the United States under the administration of former President Donald Trump, which resulted in a trade deal in early 2020. He is expected to take over the position in early 2020.

According to a report from the Wall Street Journal (WSJ), Liu, who has served as China’s top economic official for the past decade, will stand down from his present post but is likely to continue to play a role in the relations between China and the United States.

If you enjoyed reading this post, please share your feedback with us in the comments box below. In addition, don’t forget to check back on our website News Conduct for updates on the most recent financial news.